|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Read the latest updates from Graeme Colley, a respected educator, policy advisor, and technical expert with over 30 years' experience in taxation and superannuation.

In Graeme’s final update of 2025 – he reflects back on 2025 while adding some thoughts to what 2026 may hold.

Welcome to the end of another year and our last newsletter for 2025. This year has given us some possible changes to super, rulings from the regulators and greater obligations for super fund auditors.

But seeing it’s the festive season and a time of giving, why not give a gift that lasts the test of time, like super. Give yourself a Christmas present by making personal contributions to super, increasing your salary sacrifice or helping family members boost their retirement savings. While contributions to super may not have an immediate impact, they may actually give a substantial long-term benefit.

When looking back at the year, the main super issues centre on maintaining good fund administration. This includes making sure pensions are paid correctly and that auditors carry out

their professional duties properly.

An important change to anyone receiving a pension is to make sure that at least the minimum amount is paid. Failure to meet this requirement results in the pension ceasing from the start of that financial year, and all payments being treated as lump sums. Anyone wishing to recommence the pension must go through the process of starting a new pension in the next financial year with entirely new documents as well as calculations.

Underpaying the pension means additional income tax for the fund, as the amount supporting the pension will be treated as being in the accumulation phase for the year of the underpayment. Also, there may be transfer balance cap issues when the pension is stopped and if a new pension commences. One good way of making sure at least the minimum amount is paid can be to arrange for direct debits from the fund accounts to the pensioner. That way, there is a greater risk of the pension complying with the rules.

For auditors, this year provided a number of salient lessons from the regulators and the courts as they took a tougher line on the need to maintain records and gather appropriate evidence in support of the auditor’s conclusions. Failure to meet these requirements resulted in many auditors being disqualified to audit an SMSF.

If you’ve been in this position before and are looking to avoid this in 2026, you should consider speaking to the team at Cloudoffis, whose technology helps maintain records in the cloud.

The reannouncement of Division 296 tax on the increase in super balances above $3 million raised it’s head again. However, changes were made due to the reaction of the public and professional associations. The result was a rework of the basic proposed rules to include a second threshold of $10 million, indexation of the thresholds as well and including only realised gains in the calculation.

It is expected that the Division 296 proposal will show its head again early next year and be passed in time for it to commence on 1 July 2026. It will be interesting to see whether it will make it into law and how the changed proposal will operate.

Unlike the Div 296 tax, Payday Super is law and will commence from 1 July 2026. That legislation requires employers to pay super contributions at the same time as an employee’s salary and wages. In view of the effort required by employers to upgrade their payroll systems, the legislation provides a transitional period to comply with the new law. A draft of the ATO’s compliance approach in the first year of Payday Super for the 2026/27 financial year is published in PCG 2025/D5.

So summing up, it’s been another challenging yea,r and next year looks like it will be no different as we do our best to comply with the continuous changes in super. All the best for the holiday season.

Whether your practice specialises in auditing or offers a full suite of accounting and advisory services, Cloudoffis has you covered with streamlined workpapers and workflows. Cloudoffis is here to help keep your practice running smoothly.

Read the latest updates from Graeme Colley, a respected educator, policy advisor, and technical expert with over 30 years’ experience in taxation and superannuation.

Welcome to some of this month’s roundup of key developments with SMSFs. From ATO compliance initiatives to ASIC audit reviews, make sure you’re up to date.

ASIC recently released Report 817 – Building trust: Auditor compliance with independence and conflict of interest obligations. The report followed ASIC enforcement action taken against several auditors and firms identified as not meeting the independence and conflict of interest requirements.

Nearly one-third of the 48 auditors reviewed breached the mandatory independence requirements. Nine auditors failed to meet rotation requirements for 14 listed clients, and five held prohibited relationships under the Corporations Act. These breaches were found across all sizes of audit firms reviewed.

The source of the breaches was due to poor systems, lack of policies, carelessness, and inadequate quality control. ASIC considered that many auditors adopted a narrow, “tick-box” approach to compliance and failed to consider threats to independence or changing circumstances during audits. Some relied on inappropriate safeguards and did not document how they assessed independence risks.

Examples of threats included excessive non-audit fees—sometimes five times higher than audit fees—and long-standing relationships between auditors and clients, some lasting up to 36 years. ASIC emphasised that independence is fundamental to audit quality and encouraged all auditors to strengthen their practices and policies.

The ATO is taking a tougher stance on late lodgement of SMSF annual returns. About 10% of 2022/23 returns remain outstanding, and similar figures are expected for 2024. The ATO’s experience is that late lodgement often signals illegal early access or other compliance issues.

Consequences for late lodgement include removal of the fund from Super Fund Lookup, which restricts contributions and rollovers, and potentially may result in trustee disqualification.

Continued non-lodgement may trigger harsher penalties. The ATO advises trustees to respond promptly to any ATO correspondence and avoid ignoring compliance letters.

Since 2007, SMSF trustees have been required to complete the ATO trustee declaration within 21 days of appointment and retain it for at least 10 years. Auditors are required to sight the original declaration and keep a copy in their audit file, along with annual confirmations that trustees continue to retain it.

However, many auditors only review copies and request new declarations when originals are lost. The ATO has clarified that if the original cannot be sighted, a new declaration must be signed. A once-off breach can be rectified, but repeated failures require an Auditor Contravention Report (ACR).

Auditors should not be lodging ACRs annually for the same fund due to missing originals if the breach has been rectified.

Breaches of regulation 8.02B of the SIS Regulations, which requires SMSF assets to be valued at market value, accounted for 12% of all reported breaches in 2024–25. Trustees must ensure that valuations for each income year are accurate, in line with the ATO’s valuation guidelines and provide supporting evidence to auditors.

The ATO is using data analytics to identify funds which have reported unchanged asset values year after year, raising concerns about compliance. Failure to meet valuation requirements can result in additional tax liabilities and administrative penalties.

Auditors must assess whether the valuation basis is appropriate and document their findings. Trustees are reminded to provide objective, supportable evidence, including all documents requested by auditors.

The ATO has seen a rise in SMSFs failing to respond correctly to release authorities—documents authorising the release of funds to pay liabilities such as excess contributions, Division 293 tax or possibly Division 296 tax in future. Trustees must release the requested amount and submit a release authority statement within 10 business days of receipt.

Non-compliance can lead to significant penalties. Trustees should regularly check secure mail channels, set reminders, and use SMSF software to track deadlines. Working closely with administrators or tax agents can help ensure timely and accurate responses.

Keeping fund contact details, including electronic service addresses, up to date is essential for receiving important correspondence.

Applications for compassionate release of super (CRS) have surged, particularly for dental treatments. Requests rose from 56,400 in 2021–22 to 90,700 in 2024–25, with costs reaching $104.4 million. Most applicants were aged 34 to 60.

The ATO, in collaboration with AHPRA, is concerned about practitioners supporting inappropriate access, especially for cosmetic procedures. Release on compassionate grounds is only available in limited circumstances, such as treating acute pain or life-threatening conditions, and requires certification from two practitioners.

Practitioners have been warned against providing financial advice without a licence and must ensure medical reports are accurate. New guidance from AHPRA and the Dental and Medical Boards emphasises that treatments should only be certified if necessary.

Writing off loans in SMSFs is being scrutinised by the ATO for breaches of the sole purpose test. Trustees need to demonstrate reasonable efforts to recover funds, including legal advice or evidence of insolvency. Without proper documentation, the ATO may see the transaction as illegal early access.

SMSFs generally cannot claim bad debt deductions unless they are in the business of lending. A capital loss may be claimed if the loan was made with a reasonable expectation of repayment.

If a member illegally accesses super, the funds cannot be returned, and any repayment to the fund will be treated as a new contribution. Trustees may face section 65 penalties, civil and criminal sanctions, disqualification, and fund non-compliance. Early access also breaches preservation standards, making the amount assessable income for the member.

Thank you for reading this months’ update.

If you are looking for more SMSF insights, you can watch Graeme’s latest webinar on demand here.

|

|||

|

|

|

|

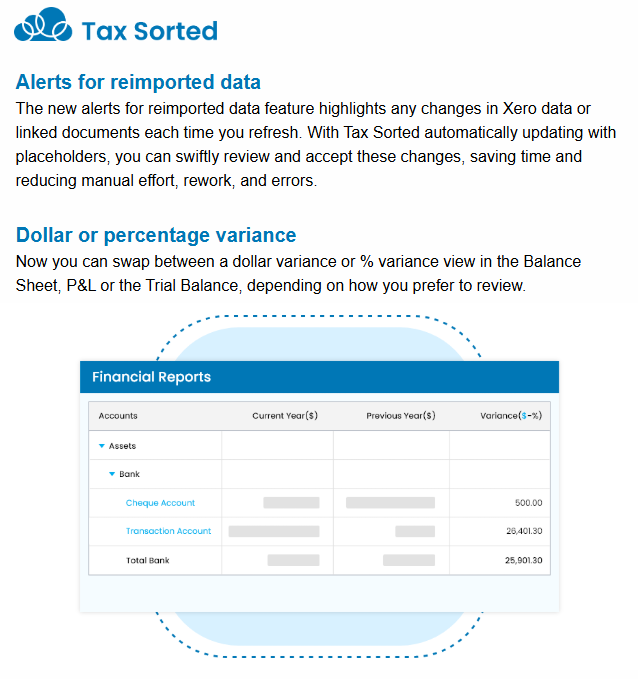

Welcome to our first-ever Cloudoffis product newsletter – Cloudoffis Pulse, where we bring you the latest product updates across Tax Sorted, SMSF Auditomation and SMSF Sorted.

This month, we’ve some really exciting updates to share with you. Our incredible product team has been working hard to build the products you’ve asked for.

We hope you enjoy this update

| We are pleased to announce that Cloudoffis has successfully attained ISO 27001 certification. At Cloudoffis, safeguarding your data is our top priority. We are proud that we have achieved ISO 27001 certification, the internationally recognised standard for information security management systems (ISMS).

You can learn more about this here. |

|

If you’re looking to elevate your Cloudoffis experience, book 30 minutes with Jocelyn or Dilnar today.

|

|

| Meet Jocelyn | Meet Dilnar |

Read the latest updates from Graeme Colley, a respected educator, policy advisor, and technical expert with over 30 years’ experience in taxation and superannuation.

Division 296 amends the income tax law to introduce an additional tax of up to 15% on the increase in a person’s Total Superannuation Balance for the year on balances above $3 million. It was intended to take effect from 1 July 2025.

Based on recent media reports the government has paused progression of the tax. If the legislation does make it into to parliament it may not be in the same form as the original bill which lapsed on 21 July 2025. It may be better to wait until we see whether the legislation will go ahead and, if it does, whether any changes are made to the lapsed bills.

It is rumoured that the $3 million threshold may be indexed which may relieve one of the main issues with the legislation. However, the member’s total superannuation balance which is used to determine the threshold may still include unrealised capital gains in the calculation.

At the moment it’s just wait and see what the government proposes to do.

Taxation Ruling TR 2010/1 Income tax: superannuation contributions has been amended by TR 2010/1A4 to provide the ATO’s view of the link between the non-arm’s length income provisions in section 295-550 of the ITAA ’97 and superannuation contributions. The amendments are relevant for trustees of super funds, particularly SMSFs, in determining whether the non-arm’s length income rules apply when making in specie contributions.

The amendments to TR 2010/1 also cover value shifting arrangements to exclude those occurring from 28 November 2024. But it covers the ATO’s approach to arrangements entered into prior to that date in Appendix 2 of the Ruling.

In relation to determining whether personal contributions are deductible the amended ruling covers the removal of the maximum earnings test which has applied since 1 July 2017.

Law Companion Ruling LCR 2021/2 has been amended by LCR 2021/2A3 to clarify how amendments to section 295-550 of the ITAA ‘97 operate in a scheme where the parties do not deal with each other at arm’s length. It applies where the trustee of small complying superannuation funds, such as an SMSF or SAF incurs non-arm’s length expenditure (or does not incur relevant expenditure) in gaining or producing the fund’s ordinary or statutory income.

The revised ruling provides clarity to a range of NALI/E issues including the difference between services provided as a trustee and in a professional capacity.

The latest SMSF quarterly statistics as at June 2025 were released in early September and highlights the continued growth of SMSFs. The ATO statistics show that there are 653,062 SMSFs which have a total of 1,203,127 members.

During the 2024/25 financial year there was an increase of 38,449 funds, which was a substantial increase over each of the previous three years. Nearly two-thirds of the increase in SMSF memberships has come from the younger age groups. Although over 50% of members are in the 60+ age group.

SMSFs now hold over $1 trillion in assets with the largest asset classes being listed shares and cash and term deposits.

The ATO’s SMSF quarterly statistical reports is available from the ATO website at June 2025 ATO SMSF statistics

The Australian National Audit Office (ANAO), has listed an audit of the ATO’s regulation of SMSFs for the 2025/26 financial year as well as a follow up audit of employer compliance with Superannuation Guarantee. The ANAO last examined the ATO’s management of SMSFs in 2007, and Superannuation Guarantee non-compliance in 2022.

The review of employer compliance with the Superannuation Guarantee requirements, compliments the introduction of the payday super which is due to commence on 1 July 2026.

If you are an SMSF auditor, the ATO must be notified if a reportable contravention under the SIS Act has occurred, is occurring or may occur. The contravention is made by lodging an Auditor Contravention Report (ACR) within 28 days of completing the audit.

However, if the ACR was sent to the ATO because of a genuine error then it can be cancelled. Genuine errors include:

If the information received after lodging the ACR shows that the reported contravention was incorrect, didn’t occur, or has been rectified, a revised ACR should be lodged with the ATO. This can be done by using the ATO’s Online services for business to request a cancellation. If the ATO considers there are valid reasons for cancellation it will reply within 28 days of the request.

In late June 2025 the Australian Financial Complaints Authority (AFCA) handed down a decision Case number: 12-00-1080719 concerning an SMSF which had invested in Contracts for Difference (CFDs) on the basis that it was a wholesale investor for purposes of the Corporations Act 2001.

AFCA came to the conclusion that the SMSF was a retail client because the financial services provided by the financial firms involved related to a beneficial interest in the SMSF, which was a superannuation product, and the SMSF held less than $10 million in net assets as required under the Corporations Act 2001.

The decision in this case changed a longstanding understanding on the basis of an ASIC Media Release 14-191MR Statement on wholesale and retail investors and SMSFs | ASIC . It indicated that if a superannuation fund held less than $10 million in net assets that ASIC would no action if the advice provider determined that the trustee was a wholesale client based on the general net assets test of $2.5 million applying to the individual. As a general rule this was taken to assume that the SMSF could be treated as a wholesale client.

However, in its decision AFCA pointed out that the Media Release 14-191MR is not a definitive statement by ASIC that the general wholesale client test applies to SMSF trustees in relation to financial services these trustees receive. In effect, the release relates to ASIC not taking action in the circumstances indicated in the Media Release.

The AFCA decision was recently confirmed by their lead ombudsman, Shail Singh, and in the AFCA newsletter dated 19 June 2025 that the Corporations Act treats everyone as a retail investor unless you fall into a category of wholesale.

Qualified accountants who have been asked to provide wholesale investor certificate for purposes of Chapter 7 of the Corporations Act must understand when it can be given for an SMSF and that the net value of the fund’s assets are calculated correctly.

The latest SMSF quarterly statistics as at June 2025 were released in early September and highlight the continued growth of SMSFs. The ATO statistics show that there are 653,062 SMSFs which have a total of 1,203,127 members.

During the 2024/25 financial year, there was an increase of 38,449 funds, which was a substantial increase over each of the previous three years. Nearly two-thirds of the increase in SMSF memberships has come from the younger age groups. Although over 50% of members are in the 60+ age group.

SMSFs now hold over $1 trillion in assets, with the largest asset classes being listed shares, cash and term deposits.

The ATO’s SMSF quarterly statistical reports is available from the ATO website at

June 2025 ATO SMSF statistics

ATO Auditor Compliance Program results for 2024–25

The ATO completed over 200 SMSF auditor reviews during the 2024–25 financial year. They referred 41 auditors to ASIC for not complying with the audit and assurance standards and 36 auditors cancelled their registration.

The main compliance issues included not obtaining sufficient and appropriate audit evidence for the auditor to form an opinion on the fund’s financial statements and whether the audited fund complied with the super laws. There was also a lack of evidence that fund transactions were at arm’s length and not reporting the fund assets at their market value.

Separation of assets

The super law requires fund trustees to keep money and other assets of the fund separate from those held by the trustees individually or by a standard employer-sponsor or their associates.

The ATO considers the fund assets must be held in the name of the trustee ‘as trustee for’ the fund. This may not be possible in some cases where the law requires an asset to be held in the name of the legal owners rather than as trustees for the relevant fund. In these cases, the auditor has an obligation to ensure the fund assets are legally owned by the fund, held by the trustees beneficially on behalf of the fund and are separate from the trustees’ personal or business assets.

Legal ownership can be evidenced by a declaration or acknowledgement of trust executed by the trustee over the fund’s asset. Where this type of documentation is not available the trustees should seek legal advice.

If the fund does not separate its assets and comply with SIS regulations it is a reportable contravention. The auditor should notify the trustees in writing of the breach and also the ATO via the SMSF Independent Audit Report if the contravention is material. Also, the breach should be reported in an Audit Contravention Report if the ATO’s reporting criteria is met.

What happens when a pension ceases?

The ATO’s opinion on when a pension commences and ceases is published in Taxation Ruling 2013/5. While it is relatively clear when a pension commences it may cease suddenly for tax purposes when certain events occur.

As a general rule a pension commences when all the capital with the purpose of supporting the income stream has been set aside in the fund. The commencement day of the pension is the first day of the period to which it relates.

In contrast, the tax ruling points out that a pension ceases when there is no member or beneficiary entitled to receive it. Examples include when:

What the ruling does not tell you is that if a client has exceeded their Transfer Balance Cap and has received an excess transfer balance determination problems can arise. In this situation the client has a number of options which include:

Where the:

the ATO is required to be notified of the event.

If a member’s super fund has not commuted the excess amount as notified in the ATO’s commutation authority within 60 days of the issue date then the pension stops being in retirement phase. This means the pension is treated as ceasing from the commencement of the relevant financial year. Any income earned on the assets that were supporting the pension are taxed as though they are part of the fund’s accumulation phase assets. Any pension payments made to the member in the financial year are treated as lump sums.

It is possible to commence a new pension from the start of the next financial year. However, the calculation of the new pension will be treated as if it has commenced from the fund’s accumulation phase assets. This may result in the taxable and tax-free amounts being different from the previous pension.

Accountants and auditors of SMSFs will need to be on the lookout for retirement phase pensions where the aggregate commencement values could be in excess of the member’s Transfer Balance Cap. In these situations, they could expect the pensioner has been notified by the ATO that there is an excess amount which needs to be commuted. If the fund has received a commutation authority then the accountant or auditor needs to confirm that the commutation has been made within 60 days of the issue date. If this has not occurred then the fund will not be able to claim an earnings tax exemption for the relevant income stream in the income year or possibly for any later income years.

Crypto currency fact sheet

The value of crypto assets in SMSFs as at March 2025 was $1.675 billion. As crypto assets are a relatively new asset class and increasing in popularity there are some fundamental issues that trustees and their professional advisers must become familiar with. This includes accounting for the asset, it’s location, storage, ownership and access to the asset which may provide a challenge.

Because of the fluid and intangible nature of crypto assets proof of the existence may depend on getting access to relevant email accounts, mobile phones and other devices. These store important asset information or are used as part of two-factor authentication or multi-factor authentication. Relying on these devices as information and storage sources creates a risk for the fund as investor. There’s also the issue of whether the crypto assets can be located, accessed and accounted for including whether successor trustees or corporate trustees in the long term have a legal right and practical control to recover the crypto assets.

The ATO has released a Tax and crypto asset investments factsheet to assist professionals and their clients when preparing fund accounts. It includes the records that need to be kept for crypto assets including income tax and CGT

This month, we’re excited to share two new webinars for our SMSF audit and accounting customers, updates on new features across all our products, and the latest from Graeme Colley’s Super News column.

We look forward to catching up with many of you in the coming weeks.

|

|

| 28th May, 12pm AEST | 18th June, 2pm AEST |

| Register today | Register today |

|

We’re thrilled to announce our sponsorship of the Australian Accounting Awards taking place in Sydney on Friday, 20th June 2025. |

In addition to our industry-leading products, we’re proud that client feedback has shaped Cloudoffis’ unique offerings, ensuring we provide the care and service necessary to keep your practice running smoothly:

If you’re looking to elevate your Cloudoffis experience, book 30 minutes with Jocelyn or Dilnar today. A quick check-in can unlock hours of productivity for your team.

|

|

| Book a Check-in | Book a Check-in |

“Cloudoffis truly overdeliver on support with a genuine generosity. They’ll call outside business hours, fix bugs quickly, and it feels like having a true partner. I can call them anytime and have a conversation.”

– Mathew, Auditomation customer

With the May Federal election now out of the way, the first thing to raise its head was the previously announced change to increase the tax on super for anyone with a balance of more than $3 million. As the proposal is not law the sensible thing to do is wait until we see the final legislation before making a final decision.

It is difficult to predict when the impact of the proposed tax will become an issue as it depends on the final law when it is passed, the member’s circumstances, such as the amount they currently have in super, the investment performance of the fund and the level of super contributions made for the member.

Before alternative arrangements to superannuation are considered it may be worthwhile to take advantage of the current superannuation rules to reduce or possibly eliminate the effect of the proposed tax if it becomes law.

It is estimated that there is a significant short fall of about $5.2 billion in employers making SG contributions for their employees. This has led to the introduction of Payday Super which is due to start from 1 July 2026. Draft legislation was released by the government on 14 March for industry consultation and feedback.

SG contributions are required to be made at least each quarter, but the introduction of Payday Super will require that employers pay super contributions for employees within 7 days of paying their salary and wages. This is a much tighter regime as the current system allows employer contributions to be made up to 28 days after the end of each quarter. If Payday Super does commence on 1 July 2026 as proposed, employers should consider improving their systems and increase the frequency making SG contributions for employees. The legislation provides a transition period commencing from the time the legislation is passed to 1 July 2026 which is the commencement date for Payday super.

Employers are in a bind as they are faced with a choice of being early adopters and changing their systems in advance of the commencement day or waiting for the legislation to pass and adopting the start date set out in the law.

Anyone who engages an employee within the extended definition of the SG legislation should keep up-to-date with Payday Super developments and how they will meet the challenge of a new law.

It’s not long before the end of the financial year is here and clients and their advisers should be thinking about what needs to be done this financial year or wait until early in the next one. Of course, before 30 June this year minimum pension requirements must be met and any contributions are actually received by the fund’s bank account by 30 June.

Anyone receiving an account-based pension must be paid at least the minimum amount which depends on their age and whether it commenced or ceased during the year. Remember, is not compulsory to pay the minimum amount of an account-based pension or TRIS for the financial year if it commences on or after 1 June.

Super contributions must be received by the fund on or before 30 June 2025. Any contributions received after that time will count towards the 2025-26 year. This could result in excess contribution tax for that year if the concessional or non-concessional contribution thresholds are exceeded. If the contributions are made by the transfer of assets (in specie contributions) it is important to ensure they are valued at their market value as required by the ATO guidelines.

Tax deductions for General Interest Charge and Shortfall Interest Charge have been removed from 1 July 2025 for any charges claimed. This may impact if either charge is imposed on:

The information in this article is intended to be general in nature and is not personal financial (or financial product) advice. It does not take into account the objectives, financial situation or needs of you or your client. Before acting on any information, you should consider the appropriateness of the information provided having regard to the objectives, financial situation and needs of you or your client.

In particular, you should seek independent professional advice prior to making any decision based on the information provided in this blog.

You should consider the appropriateness of this information having regard to the individual situation and seek taxation advice from a registered tax agent before making any decision based on the content of this blog.

Any examples and calculations within this blog are provided for illustrative purposes only. They should not be relied on. Viewing the content provided, is considered as acknowledgement,

acceptance and agreement to this Disclaimer and the contents contained within.

With the end of the financial year fast approaching clients and their advisers should check to make sure the minimum pension requirements have been met and that any contributions have been received by the fund by 30 June.

Make sure anyone receiving an account-based pension from the fund is paid at least the minimum amount which depends on their age. If the pension commenced after 1 July in this financial year the minimum amount is pro-rated on a daily basis it commenced. It is not compulsory to pay the minimum amount for the financial year if it commences on or after 1 June.

Remember that anyone who stops receiving a pension during the year must receive a pro-rated minimum pension calculated on a daily basis up to the time it ceases.

It’s important that super contributions are received by the fund on or before 30 June 2025. Any contributions received after that time will count towards the 2025-26 year. This could result in excess contribution tax for that year if the concessional or non-concessional contribution thresholds are exceeded.

If the contributions are made by the transfer of assets (in specie contributions) it is important to ensure they are valued at their market value as required by the ATO guidelines.

Tax deductions for General Interest Charge and Shortfall Interest Charge have been removed from 1 July 2025 for any charges claimed. This may impact if either charge is imposed on:

The ATO has made amendments to the ACR which relate to:

The ATO auditor compliance focus for 2025 will concentrate on:

The Budget had no new announcements on superannuation except to reconfirm the payment of superannuation from 1 July 2025 on paid parental leave.

Any further changes to super will depend on the outcome of the Federal Election and the priorities of the new parliament.

The information in this article is intended to be general in nature and is not personal financial (or financial product) advice. It does not take into account the objectives, financial situation or needs of you or your client. Before acting on any information, you should consider the appropriateness of the information provided having regard to the objectives, financial situation and needs of you or your client.

In particular, you should seek independent professional advice prior to making any decision based on the information provided in this blog.

You should consider the appropriateness of this information having regard to the individual situation and seek taxation advice from a registered tax agent before making any decision based on the content of this blog.

Any examples and calculations within this blog are provided for illustrative purposes only. They should not be relied on. Viewing the content provided, is considered as acknowledgement, acceptance and agreement to this Disclaimer and the contents contained within.