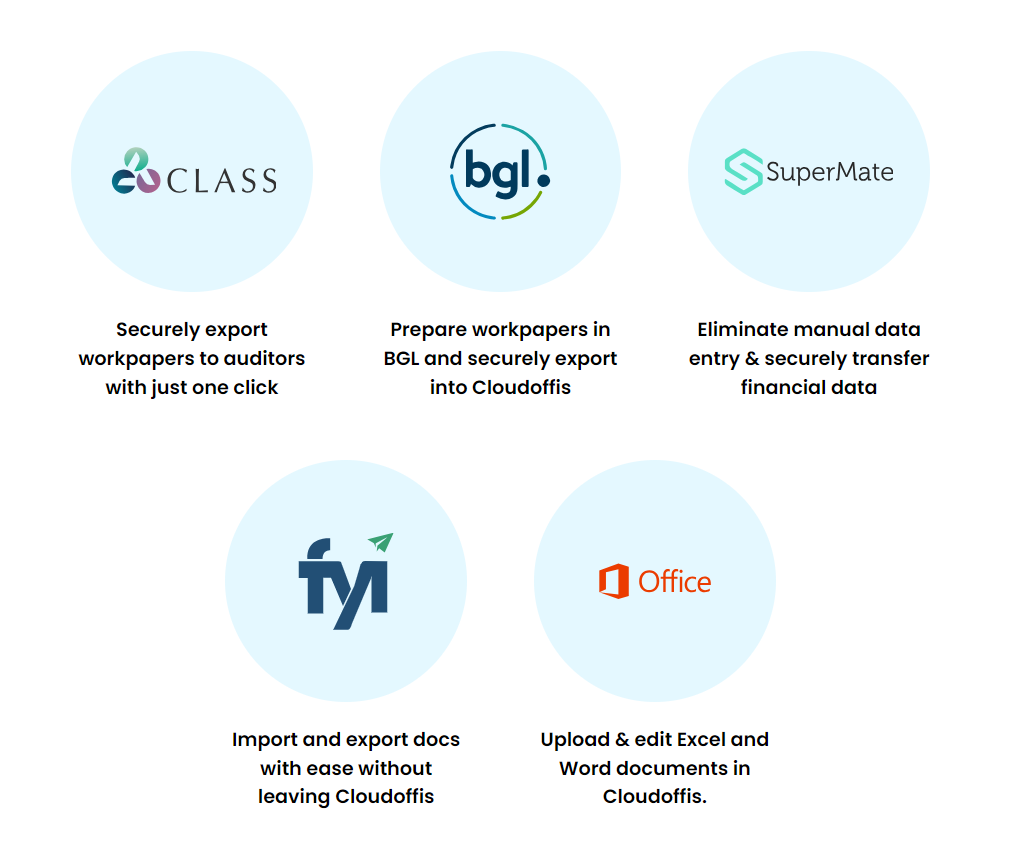

As we kick start the new financial year, we’re excited to share the latest features we’ve packed into Cloudoffis. These updates are designed to ensure you enter FY25 with enhanced efficiency across your practice and improved communication and transparency between accountants and auditors.

We’ve been busy, so grab yourself a coffee and get into the updates!

Transform Your SMSF Workflows:

New features across Auditomation & Sorted Pro

Import & Re-import Flow in Auditomation & Sorted Pro

We are thrilled to announce a revamped Import & Re-import Flow for both Sorted and Auditomation! 🎉 Experience the new, efficient workflow today.

What’s New?

-

Instant Access: The moment you import financial data, you can jump straight to the job dashboard. No more waiting around!

-

Improved Efficiency: Financial data is accessible immediately while other data like observations, reports, and documents load in the background.

-

Enhanced Performance: With backend optimisations, system performance is significantly boosted, ensuring smoother execution and better resource management.

-

Streamlined Processes: These enhancements will make your existing processes more efficient, saving you valuable time.

Introducing ‘Waiting for Response’ Stage in Sorted and Auditomation!

We’re excited to introduce a new job stage, ‘Waiting for Response,’ to improve your workflow and communication! 📈

Problem Solved:

- Auditors often have to pause audit job processing while waiting for responses from accountants. They typically change the job status to ‘Waiting for Client,’ but accountants cannot separately track these jobs, leading to delays.

The Solution:

- New Job Stage: The ‘Waiting for Response’ stage will be introduced to accountants using Sorted and Sorted Lite, allowing accountants to easily track jobs pending their response.

- Improved Turnaround Times: This new stage will streamline communication and speed up the turnaround times between accountants and auditors.

Big News for Auditomation Users

Reimporting clients details

We’ve listened to your feedback and are excited to introduce a new solution for re-importing client details in Auditomation! 🚀

What’s new?

-

One-Click Re-import: Now, with just one click, you can re-import client details. Fund, member, and trustee information will be updated automatically, ensuring accuracy and saving you time.

- New ‘Add Alternate Address’ Field: You can now add an alternate address in the client details page. This new field is used for generating audit letters and reports with the alternate address, we’ve also added a placeholder called ‘Alternate Address’ to make it seamless.

These updates will drastically reduce manual efforts and enhance accuracy in your auditing process.

BGL Workpaper Docs

We’re excited to bring Auditomation customers a major time-saving enhancement: Auto Availability of BGL Workpaper Docs! 🚀

Previously, you had to manually convert each BGL Workpaper document to a Cloudoffis-supported format to use our bookmarking and search features. This was time-consuming, especially with a large number of documents.

The Solution:

-

BGL Workpaper documents will now be automatically converted to the Cloudoffis-supported format. No more manual conversions needed!

Billing Module & Practice Management

Whilst the Cloudoffis Billing module and Practice Insights were already available in the old version for Auditomation customers, we’ve now integrated them into the new version for a more streamlined and user-friendly experience. 🎉. Discover how Cloudoffis can streamline your practice management and enhance your workflow.

Checklist for FY24

Since there were no updates from the ATO this year, we’ve taken the opportunity to revamp and clarify our checklist for better understanding and ease of use.

Exciting updates for Class customers using SMSF Sorted Lite

We’re excited to announce more updates to enhance your SMSF Sorted Lite experience.

What’s new?

- The audit console page is now even more action-oriented, allowing you to upload documents, submit jobs for audit, and download workpaper files directly from your Sorted Lite account, making your workflow smoother and more efficient.

- The query module has been improved, enabling accountants to filter pending queries and prioritise actions for faster turnarounds.

- We’ve made it easier for auditors to join the Cloudoffis Auditomation Pro platform, streamlining their audit processes and improving collaboration with Class accountants who use Sorted Lite, guaranteeing faster turnaround times.

$50 referral bonus SMSF Sorted Lite accountants

- Did you know that as an SMSF Sorted Lite accountant, you can earn a $50 referral bonus when you refer your auditor to use Auditomation? Not only will you gain more control over every fund you manage, but you’ll also be able to automate your workpapers and submit audits to your auditor with just one click. This will help speed up the turnaround time of funds, as auditors will receive more structured data to work on. You’ll both benefit from easier collaboration with improved query management tools.

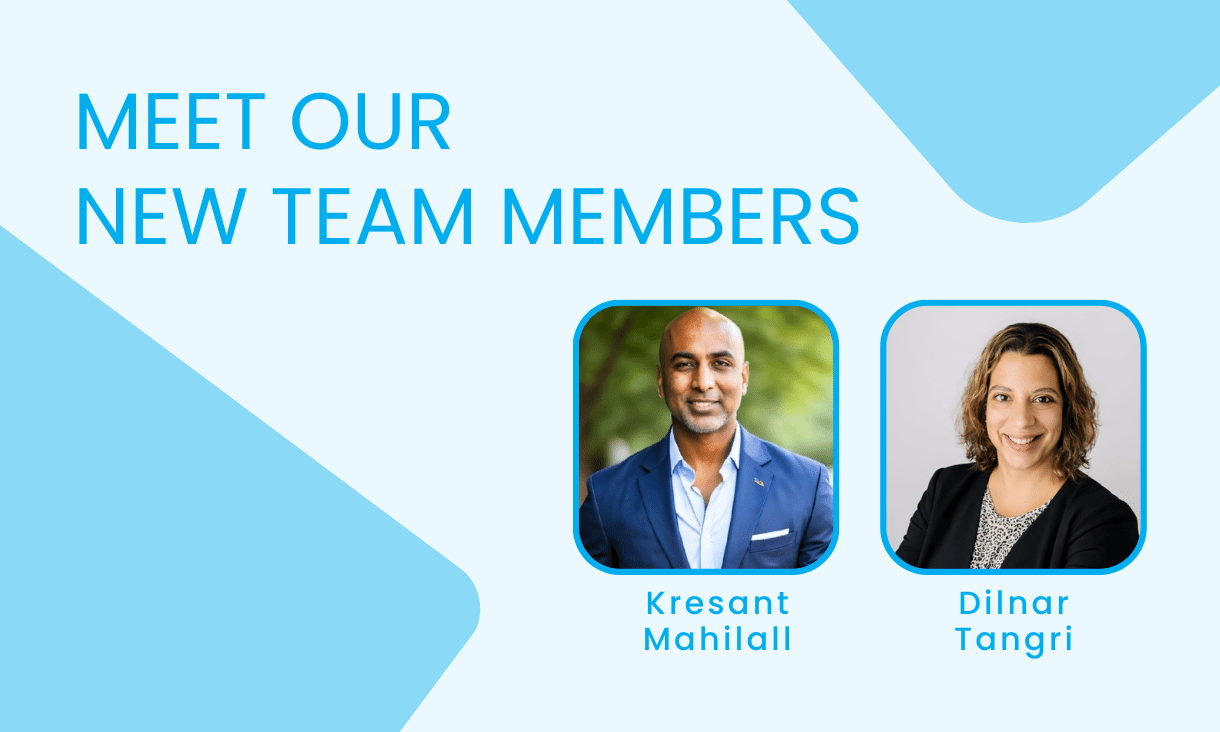

We love nothing more than investing in improvements to enhance your workflows and we continue to lead the industry with our product innovations. If you’d like any further information on the features we’ve delivered, reach out to Kresant in Sales or Dilnar and Jocelyn in Customer Success.

Read more about these releases in detail