With the substantial changes to superannuation rules in action since July 2017, it’s a good time to take stock of the emerging trends in the SMSF industry.

Trend #1 Catering to a unique population

The superannuation population now consists of a really interesting and challenging age mix. The Baby Boomers, Generation Y and the Millennials. An aging and increasingly diverse community along with the current technological advances are bound to reshape the superannuation sector. Super funds will increasingly tailor their offerings to this new reality.

The millennial investors are more digitally savvy and happy to embrace automated investment advice compared with aged investors (60+). Studies also show that millennial investors are strong adopters of mobile apps and cloud-based technologies.

Trend #2 The age of Automation

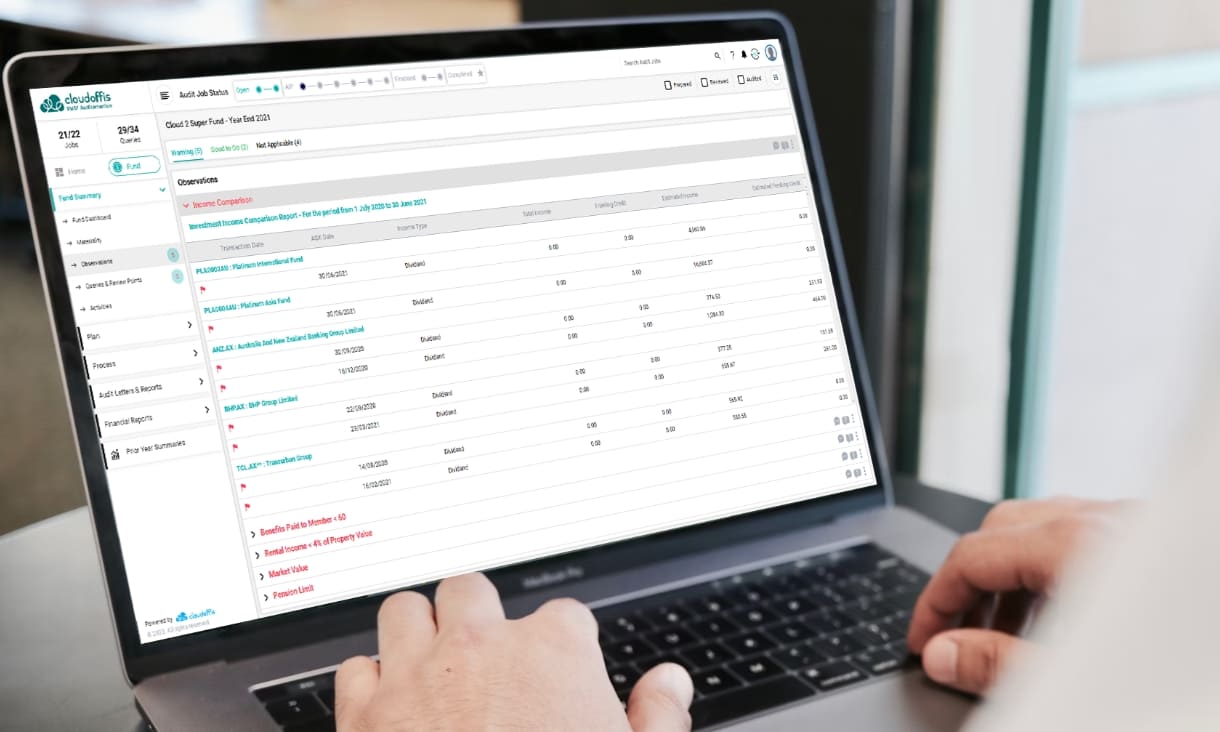

Yet another emerging trend is the advent of automated processes and tools. Like any another industry, automation is bringing in significant change and efficiency in the way SMSFs are managed. Cloud-based technologies are automating a variety of cumbersome day-to-day processes.

Live reporting and greater visibility offer better decision making for trustees. Automated audit platforms are revolutionizing the way in which SMSF audits are conducted. These tools are saving auditors a significant amount of time and helping create high quality audits. Automation ensures a high level of accuracy, improves client experience and allows firms to improve their scalability.

Trend #3 The need for events-based reporting

The ATO is asking firms to notify them of some events 28 days after the month in which they happened and to notify them of other things 10 days after the end of the month in which they occurred. Increased events-based reporting means firms will need to have automated processes in place. Surprisingly, in a recent poll on the SMSF Adviser, only 23% of the accounting firms said that they were ready for ATO’s events-based reporting requirements.

Trend #4 The swing towards managed funds

The investor market seems to have an appetite for managed funds. Studies show that investors tend to have more faith in managed funds, as they provide more stability and confidence in a volatile world. While SMSF trustees are interested in investing in a diverse portfolio of funds, they don’t have enough time to select and research their SMSF.

The new Super reforms from July 1st limit the role of accountants – they can no longer provide SMSF advice to their investors without obtaining a license. This means, Advisers specializing in Managed Funds will benefit significantly. The SMSF space will also see new licensing requirements for accountants who want to provide more holistic advice to their SMSF clients.

Trend #5 Greater innovations for the future

With increased life expectancy, trustees look for a better control over their financial future. They are on the lookout for innovative strategies for the future. Real-time tools that offer personalized interaction with members through portable devices; the ability to make instant decision making strategies on a personal level; and a clear forecast on the returns. Trustees are also interested in innovative strategies/tools that spread awareness and demand engagement from an early age.

Some of the examples being cradle-to-grave products. In the age of information revolution, smart phones, cloud-based technologies and social media, 2017 will look for newer ways to bring in efficiency in SMSF investments, administration and audit – not just in the face of regulation but to meet consumer expectations for the future.

References:

1. BNP Paribas article March 2015 ‘2025: What will the superannuation industry look like in a decade?

2. Top 10 trends in the Australian wealth management industry

3. Investment Trends Survey Highlights

Disclaimer: The content provided on this blog is for information only. Cloudoffis cannot be held responsible for any loss incurred as a result of using information on this blog. Persons accessing this information are strongly encouraged to obtain appropriate professional advice before making any investment or financial decision.