Summary

The Business: Super Green Tick

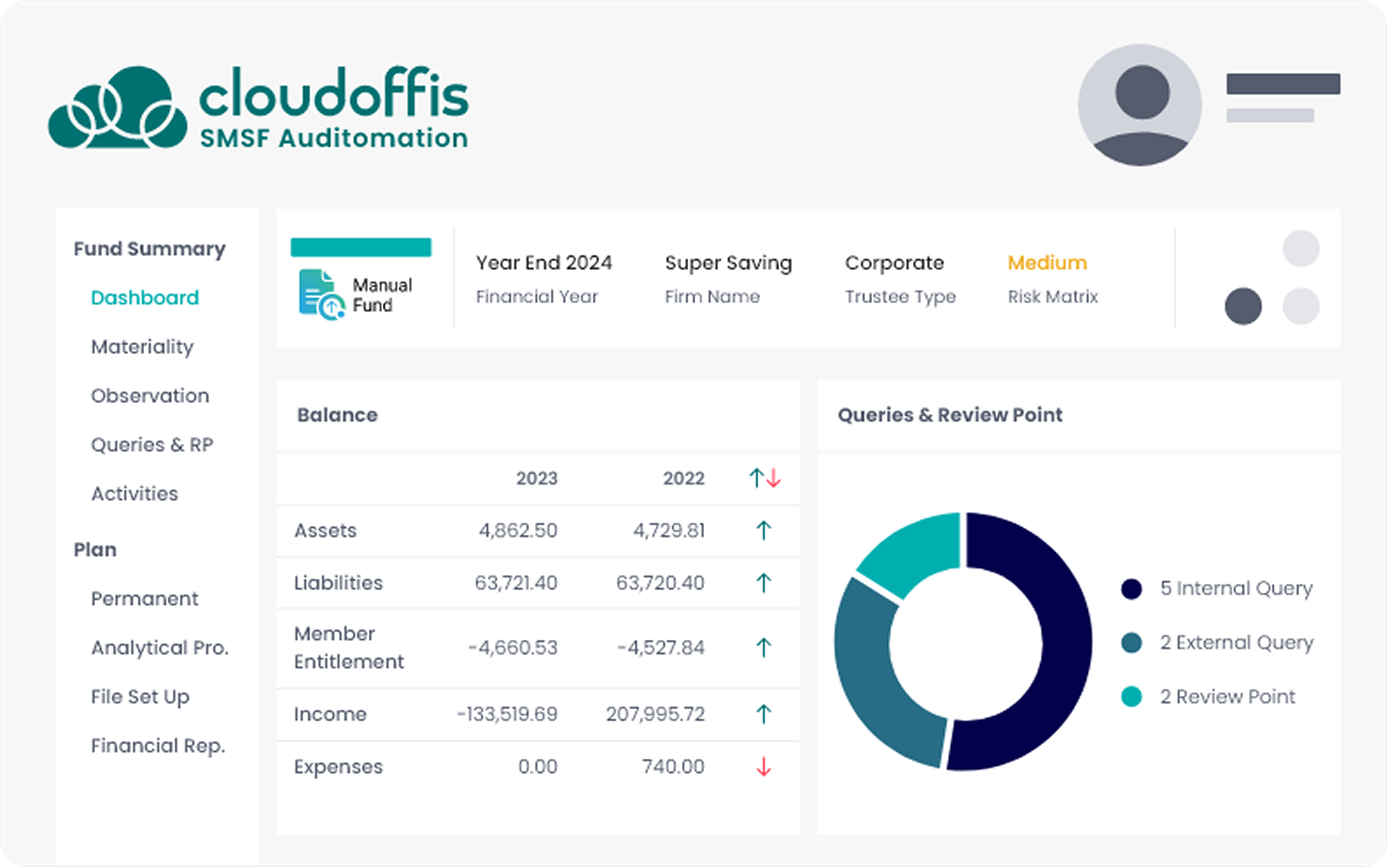

Product: SMSF Auditomation

Industry: SMSF Auditing

Role Interviewed: Peter Gallagher, Director

Cloudoffis Customer: 7 Years

Key Result: 50% business growth with no increase in staff

Super Green Tick is a specialist SMSF auditing firm dedicated to providing high-quality, professional SMSF audit services to accounting firms and SMSF administrators.

The Challenge: Scaling an Audit firm without adding complexity

As a specialist SMSF audit firm, Super Green Tick’s success depends on efficiency, consistency, and confidence in their processes. Director Peter Gallagher, with a background spanning Big Four auditing and finance director roles, was focused on one thing: building a scalable audit operation.

Before adopting Cloudoffis, the firm relied on largely manual processes. In 2015, Gallagher introduced a cloud-based workpaper solution to move away from paper files, but it came

with limitations.

“Approximately half of our audits still required manual work because the software only worked with certain platforms.”

Managing multiple processes depending on the client’s software stack created inefficiencies in training, reporting, and quality control — all barriers to growth.

Searching for a better way

After using their existing software for 2 years, it became clear that the platform was not delivering any efficiency. Peter was back in the market for a new solution, unfortunately there were not many SMSF Audit software options available – only 2 to 3 in the market. Then, Cloudoffis reached out to Peter to showcase SMSF Auditomation.

After seeing a demonstration and speaking with the team, Super Green Tick saw a lot of potential and personally loved Cloudoffis’s commitment to investing in growing the product and working with customers to ensure we meet their requirements.

Cloudoffis offered everything their current solution provided – but added automation and observation reporting, which fundamentally changed how audits were performed for the business.

“It gave us all the functionality we already had, plus automation that actually made a difference.”

Implementation of SMSF Auditomation was a seamless experience for their team, Peter highlighted that it was a simple process and the team were up and running quickly. It felt intuitive, much like an iphone. It just makes sense.

“By digitising you reduce paper, you can find things easier due to search functionality etc and you just don’t need to be scared of it – Cloudoffis is like using an Apple iphone, it’s pretty intuitive – not all products are but Cloudoffis is.”

The Solution: One Platform, One Consistent Process

Super Green Tick transitioned fully to Cloudoffis within two years, ultimately deciding to run 100% of their audits through a single, consistent workflow, even when some clients weren’t yet fully automated. This is when they saw a huge impact on their business.

“Having multiple processes just wasn’t efficient — for staff training, reporting, or quality control. We wanted one way of doing things.”

As their client base increasingly adopted BGL 360, automation accelerated. What was once a 60/40 split between automated and traditional audits is now closer to 90% automated.

Some of the features that really drove impact for Super Green Tick were observation reporting, automated workflows, and the reporting templates which only got better over time as Cloudoffis evolved the product. Peter describes this evolution as the “beginnings of AI,” laying the groundwork for even greater efficiency.

SMSF Auditomation’s reporting automation proved especially valuable, automatically selecting appropriate report types and managing common audit issues.

The impact: Growth without the headaches

The impact on productivity was clear and measurable. Super Green Tick were able to grow the firm without having to invest in additional headcount.

Results achieved using SMSF Auditomation:

- 50% business growth with the same staffing level

- Significant reduction in audit time through exception-based reviews

- Increased confidence in audit quality and consistency

- Improved staff collaboration through a single, clear process

Since implementing Cloudoffis, Super Green Tick has seen their audit turnaround time drastically reduced from 3-5 days to a consistent 1.5 days. This improvement has led to a better client experience, with Super Green Tick receiving positive feedback that their turnaround times are now well above client expectations.

‘’Communication with clients has also improved because we have reduced email interaction and there by ensure all issues are captured and reviewed prior to sign off.’’

Another meaningful impact is that using Cloudoffis has also strengthened regulatory confidence for the firm. In 2025, they were audited by the ATO – this can be a stressful procedure for many firms. However, with Cloudoffis on their side – this was not the case.

“When the ATO audited us and we mentioned Cloudoffis, there were no further questions about our software. They were comfortable with the process and moved on.”

Advice for Firms Digitising Their Audit Process

For firms considering digitisation, Gallagher offers clear guidance:

- Implement the full workflow from day one — and make the business fit the software. You will get the benefits much sooner this way.

- Tailor your audit program templates to your specific risk profile. Take the time to invest in the comments.

- Prepare templates for common issues and reports to save time in the back end.

“Observation reporting alone changes everything. You stop sifting through documents and start focusing on what actually matters.”

If you’re a firm looking to automate your SMSF audit process today, you can learn more about SMSF Auditomation here.

You can book a demo with a Cloudoffis expert here.