Auditors and accountants have to adapt to the new legislation on SMSF reporting. There have been significant changes in SMSF processing, and it’s crucial to keep up with them. In July 2018, a new framework for SMSFs was introduced which requires certain events to be reported to the Australian Taxation Office (ATO). Event-based reporting is a new obligation SMSFs need to fulfill. SMSF annual returns are still mandatory.

However, this new reporting style aims to capture information about other events as they occur. In certain cases, SMSFs have to file transfer balance account reports (or TBARs). There is now an increased need for real-time accounting. TBARs may need to be filed at any time during the financial year. Additionally, there’s a strict time limit on TBAR reporting.

Hence, the SMSF industry is going to have to make some fundamental changes. Accounting and auditing will have to become faster and more cost-efficient. In many cases, you’ll lodge within 28 days of the end of the quarter. Some TBARs need lodging sooner, whereas you only need to lodge others annually.

What about auditing? TBARs give auditors a new set of challenges. They’re still invaluable to the process, but the use of TBARs means they have to adapt to a new environment. Let’s overview the top facts about TBARs, as well as the ways that auditors will have to update their practices.

What Is a T BAR?

The ATO introduced TBARs to help them with a specific issue. Previously, the ATO had to wait for extended periods to receive data about how much people have allocated across the various phases in their superannuation funds. In some cases, they have to wait for almost 11 months to receive data about SMSFs. T BAR allows the ATO to track a member’s significant events and key transactions during the retirement phase. The ATO has applied a transfer balance cap of $1.6 million to this retirement phase.

TBARs allows you to track a transfer balance account to work out if there’s space for further activity. It also highlights if you’ve exceeded the cap through recent activity. TBARs allow the government to track large transfers. SMSF members now have their total superannuation balance monitored too. This is the sum of all their accumulation and retirement phase superannuation interests across all their accounts and funds. If it goes over $1 million, the SMSF has to lodge more frequently.

Which Events Require TBARs?

It’s crucial for accountants to keep track of each SMSF member’s transfers and superannuation balance. Accountants must report key events that alter an SMSF member’s transfer balance. Check the ATO’s guide here. A short summary follows:

- The Type and Value of Pre-Existing Income Streams Details of pre-existing income streams being received on 30 June 2017 that will continue to be paid or will remain in the retirement phase on or after 1 July 2017. It’s not necessary to file a TBAR when the interest from an income stream has been exhausted.

- The Type and Value of Death Benefit Income Streams and New Retirement Phase Income Streams Reversionary death benefit income streams should be filed starting from the date of death. Note that it’s not necessary to file a report upon the death of an SMSF member

- New or Re-Financed Limited Recourse Borrowing Arrangement (LRBA) Payments ‘New’ refers to borrowing arrangements entered into on or after 1 July 2017 and the payment results in an increase in the value of the member’s interest that supports their retirement phase income stream.

- Personal Injury Contributions

- Commutations of Retirement Phase Income Streams that occur on or after 1 July 2017 or Compliance with a Commutation Authority

There are some exclusions to consider in the reporting too. For example, accountants don’t have to worry about filing a member’s APRA fund interests as the funds will report these. Information filed directly via a Transfer balance event notification form (NAT 74919) also doesn’t need to be included in the T BAR.

How Does TBAR’s Introduction Change the Compliance Process?

It was necessary to file all information about pre-existing streams by 1 July 2018. After this date, TBARs cover new events. If every SMSF member has a total superannuation balance lower than $1 million, the TBARs aren’t urgent. They can simply be filed once a year along with the Annual Return. But this changes if any member has a total superannuation balance of over $1 million. In this case, the SMSF has a new obligation. When an event occurs, they have to file a TBAR within 28 days after the end of the quarter. Events apply to all members, including members whose total superannuation balance is under $1 million. Let’s overview the main points.

- The ATO will notify you in the event that you exceed the $1.6 million cap. It will ask you to rectify the event.

- There is no legal limitation on the superannuation balance of SMSF members. But if anyone’s total superannuation balance goes over $1 million, a TBAR must be filed.

- The ATO now has more insight into all SMSF income streams.

- When you file depends on the fund’s composition and each member’s total super balance. As mentioned previously, you’ll often file within four weeks of an event. However, there are plenty of exceptions. For example, in the case of commutations, the SMSF may have only ten days after the end of the month to file a TBAR.

This is a new piece of legislation, so we may see changes made over time, particularly in regard to caps. For example, the $1 million superannuation criterion might be re-evaluated over time. Furthermore, the Treasury has a new proposal to change the audit cycle from one year to three years. If the measure passes, it will commence on 1 July 2019. However, the idea is still under much debate. Interestingly, this proposal sits at odds with the value and oversight that event-based reporting provides. With longer audit cycles, the ATO’s level of oversight would decrease. This might undo some of the positives that come with TBARs.

Your Responsibilities

When the July 2018 deadline came around, many SMSFs failed to comply with the new legislation. In most cases, the failure came from a muddled understanding of the rules. Some SMSF accountants didn’t understand the proper treatment of income streams under the new legislation. Some of the clients failed to comply with the transfer balance cap. This often happened because they failed to inform their accountant about their other super fund balances. People simply didn’t know which data was relevant. Since July, various SMSFs struggled with sending up-to-date TBARs. Many accountants had to get used to the new software in order to generate these reports and have had to change their practices to ensure data is up-to-date and accessible. As an auditor, ensuring you have a solid understanding of TBAR reporting is one of your responsibilities. This means you have to have clear oversight over all of your client’s income streams, other key events and any breaches of the transfer balance cap.

What Does This Change?

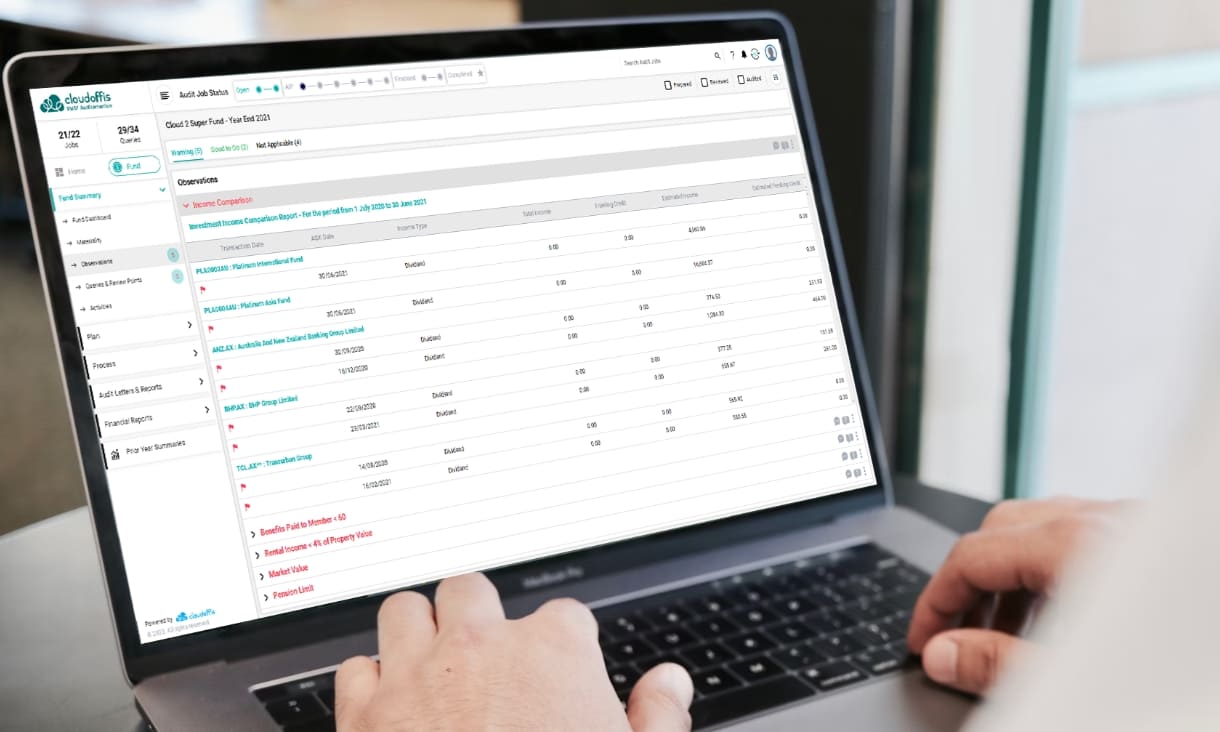

With these changes, the accounting and auditing process has to become more proactive and access to up-to-date data is imperative. SMSF professionals have more data to go over and processing frequency will need to increase. However, your main task lies in understanding the compliance and data requirements that will allow you to support the fund under this new framework. Many auditors hesitate to rely on data feeds. But if you find feeds that have a reliable source and structure, you won’t compromise the quality of your work. Data feeds can be secure and almost entirely error-free. At the same time, auditors will need to have a more active relationship with their clients. Being able to source reliable data and communicate regularly with clients can make it easier to keep on top of your requirements, identify areas of focus, and help to better support the SMSF with the new compliance regime.

The Final Word

TBARs whilst complex, have made a positive contribution to the industry in providing more visibility and transparency of key information. Clients and their SMSF professionals are still in an adjustment period. But the reporting process should soon become routine. It’s impossible to keep up with these changes without altering your process. Becoming well-versed in data feeds and understanding what online access to data and reporting you can receive is one of the ways that can assist Automation enables you to more easily and cost-effectively identify areas for focus. But there are many other ways to improve your processes. At Cloudoffis, we offer a variety of industry-specific innovations. To learn more, get in touch with us any time.