SMSF is about choosing today what gets you ready for tomorrow. For Daniel Surjenko of award-winning SMSF auditors Superannuation Audit Services, moving to the cloud was about creating a better future—for the firm. “In moving to the cloud, we knew we’d reap the benefits of modernisation—including speeding up our process, sharpening accuracy and creating uniformity”, says Daniel. “What we didn’t realise is that moving to the cloud would create a better future—for our family.” In reducing errors, creating flexibility and reducing stress, Cloudoffis gave Daniel and the team more time for living. “We have more time to be a family,” says Daniel.

Writing on the wall.

Superannuation Audit Services was founded in 1996 by Denise Surjenko—Daniel’s wife—to provide independent SMSF auditing services to public practitioners. Since then, the business has built a reputation based on continued excellence and a personalised, on-shore service. They’ve also seen the industry change drastically. “Audit legislation is an ever-changing game,” says Daniel, “Staying ahead of changes is critical—it’s what clients have always relied on us to do.” It’s one of the reasons Superannuation Audit Services performs over 1200 audits annually and has retained foundation clients for over a quarter of a century. “When it came to going paperless, the writing was already on the wall,” says Daniel, “Well before COVID, we’d noticed the digitisation of our industry—we knew we needed to act or face getting left behind.” For Daniel and the team, improving efficiencies was critical—staying paper-based was restricting their growth. “In addition, our clients were going cloud-based,” says Daniel, “We didn’t want to be the bottleneck—we had to integrate or wave goodbye.”

Choosing the right software.

Moving to the cloud was not something Daniel took lightly. “We had reservations about automation in general,” says Daniel, “Our process and filing system was watertight and built to last—we needed absolute confidence that our software could match that.” Initially, Daniel considered building their own software. “While on the face of it, it seemed like the better route would be to build software in-house, giving us complete ownership over it,” says Daniel, “But we quickly realised the costs and risks involved.” According to analytics firm Gallup, custom IT projects overrun by 27% on average and ‘one in six projects had a cost overrun of 200% on average and a schedule overrun of almost 70%.’ ” “We understood how damaging inaccurate cost estimations and project overruns can be”, says Daniel, “The ease, security and transparency we’d get from choosing to buy vs. build made the decision a no-brainer for us.”

Choosing the right partner.

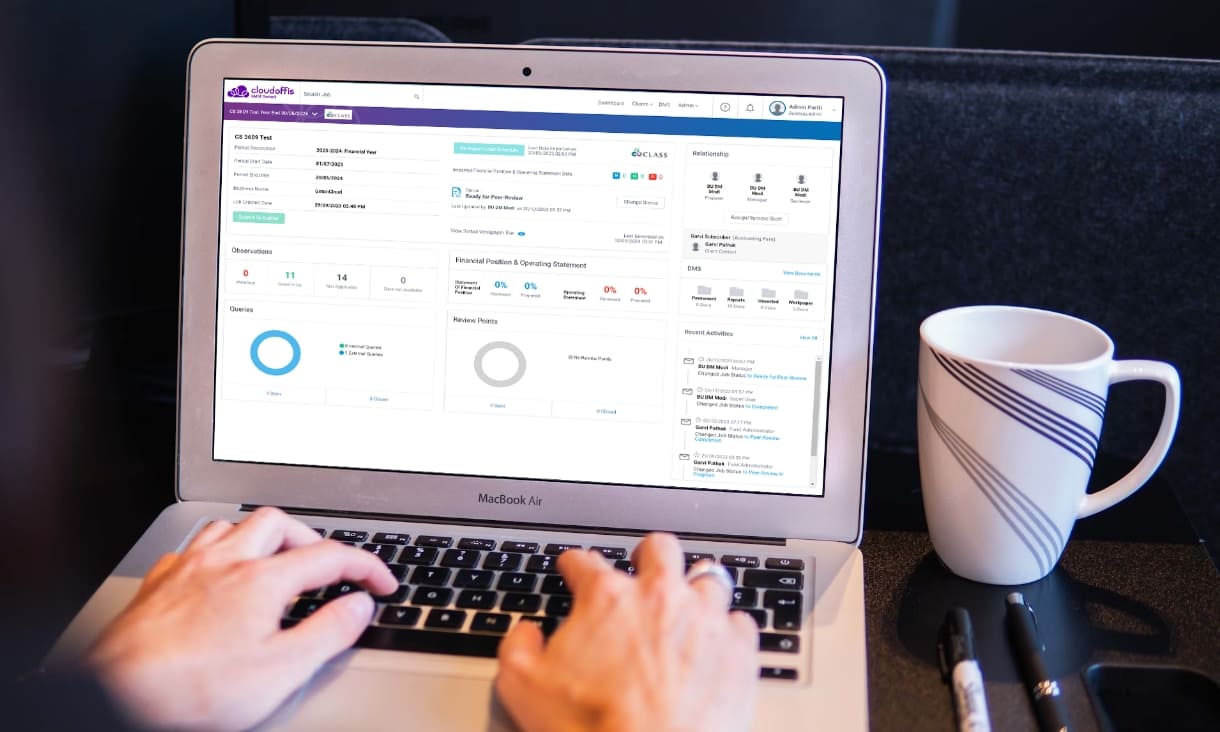

Having decided to buy, it was time to find the right partner. Daniel interviewed multiple SMSF software providers, even flying to Sydney to personally meet with them. “Choosing to work with Cloudoffis was a very considered decision,” says Daniel, “They had the best value to service combination, a second-to-none user interface and user experience, and enterprise-grade security.” “We also had access to their key staff and we trusted them. The exceptional training they provided for our staff meant no one was left behind.” The future doesn’t wait—Cloudoffis’ plug-and-play solution took Superannuation Audit Services from on-boarded to auditing in a matter of weeks. Like Superannuation Audit Services, the Cloudoffis team is based in Australia. It means businesses and their clients can access personal support from an expert local team—on-demand. “We went paperless—without the learning curve,” says Daniel, “Everyone’s loved it.”

Prepped ahead of a pandemic.

With young kids at home, Daniel and Denise often worked remotely—and encouraged their staff to do the same. “Before Cloudoffis, we were still running around with stacks of paperwork,” says Daniel, “Once we moved to the cloud, we could do everything securely online—from document organisation to receiving files, reviewing work, sharing jobs and populating reports. We were well ahead of the technology curve.” When COVID hit—and competitors scrambled to stay afloat amid world-wide lockdowns—Superannuation Audit Services didn’t miss a beat. “We had clients messaging ‘are you still around,’ ” says Daniel, “and we were like ‘nothing’s changed here!’ ”. In fact, Daniel and the team were helping their clients get on the cloud too. “Cloudoffis offers training for clients in how to use their portals,” says Daniel, “Going that extra mile has kept us highly competitive.”

More time for living.

Going paperless has shown Superannuation Audit Services the way of the future. “We can standardise every job—no matter the source. We have uniformity across all staff members—making reviewing easier. We’re freed up to do marketing because we’re not drowning. And we’re quicker—with a faster audit process there’s just more time for everything,” says Daniel. That includes being a family. “We’re less stressed and have a better lifestyle. Despite lockdown, we’re able to stay fit—we go to the park at lunchtime with the kids and have time to help them with school and assignments,” says Daniel. “With SMSF Auditomation we got our time back, achieved growth and are closer than ever as a family.” There’s also excitement about what’s possible with new Cloudoffis AI features in SMSF Sorted for Accountants—which will make the workflow for Auditors even more efficient.. “We’ve seen Cloudoffis evolve—they’re consistently reducing pain points and we couldn’t be happier,” says Daniel, “Compliance review still has a manual, human side—so we’re excited about the possibilities from new releases on the administration and transfer to audit side, like AI-driven data matching, which could transform our efficiency.”

Consistent, compliant and automated, SMSF Auditomation leverages tech to free you from the grunt work—leaving more time for what counts. Book your live demo today or call 1300-979-457.