Division 296

Q: Could you please share your thoughts on Div 296?

A: As of the most recent sitting of Parliament last week, the bill has not been included in the government's list of priority legislation, raising questions about its viability and the likelihood of it becoming law in this term of the Parliament.

On 27 November Senator Dean Smith (WA) moved a motion in the Senate to divide The Treasury Laws Amendment (Better Targeted Superannuation Concessions and Other Measures) Bill 2023 into two bills – one bill which includes only the Div 296 amendments and the second bill which will cover the ‘Other Measure’ part of the original bill. The other measures relate to increased public transparency of Australian Charities and not-for-profit organisations and amendments to the Corporations Act to provide exemptions for foreign financial services organisations to hold an AFS licence.

With the likelihood of only one more parliamentary sitting scheduled in February (4-6 and 10-13 of February) before the next Federal Election, the future of the proposed Div 296 tax remains uncertain. It appears increasingly unlikely the Bill will be introduced in its current form to commence by 1 July 2025.

The issues with the introduction of Div 296 are:

Main issues:?

- Taxation of the ‘growth’ element including unrealised capital gains on a year-by-year basis, and

- Lack of indexation of the $3 million threshold.

Other issues:

- Valuation of fund assets

- Lack of flexibility to withdraw benefits

- Payment of the tax from the funds which have illiquid assets

- No notional CGT discount on assets owned by the fund for greater than 12 months,

- No adjustment to losses carried forward if the member’s adjusted TSB (total

superannuation balance) falls below the $3 million threshold, and.

- Effective double tax on capital gains and unrealised capital gains attributable to the

adjusted TSB

Q: What is the current status of Div 296 and how is it calculated?

A: Division 296 in its current form in the The Treasury Laws Amendment (Better Targeted Superannuation Concessions and Other Measures) Bill 2023 and the Superannuation (Better Targeted Superannuation Concessions) Imposition Bill 2023 calculates the tax in three stages as follows:

– Stage 1

Adjusted Total Superannuation Balance

Adjusted TSB = TSB for the current financial year + lump sum and pension withdrawals for

the year – any contributions for the year

Withdrawals (added back)

• Lump sums

• Income streams

• Spouse contribution splitting

• Family law splits

• Div 293 payments made under a release

authority.

Contributions (deducted)

• Concessional contributions less tax

• Spouse contribution splitting received in

account

• Family law splits received in account

• Transfer of death benefit to beneficiary

• Transfers from reserves

– Stage 2

Proportion of earnings above $3 million

Where:

TSB means the person’s adjusted total superannuation balance for Div 296

purposes

– Stage 3

Calculate Tax Liability

An example of a calculation of the Div 296 liability for a person is included in the slides.

Q: Preparation for Div.296 – Is planning worth it given that it’s unlikely anything will be passed before Christmas?

A: There are no more sitting days of the Parliament this calendar year which means the bills won’t be passed before Christmas 2024. As it seems very unlikely the bills will be debated in the Senate before the next election the legislation may not be passed before the Federal election is announced. If that’s the case then all bills that have not passed into law when the lection is called lapse. The bills are then required to be reintroduced into the House of Representatives and Senate and their reintroduction depends on what the incoming government decides.

Death benefits

Q: What is the timeframe for paying out a death benefit? It covers some practical aspects on death benefit payment complexities.

A: Regulation 6.21 of the SISA requires that death benefits are paid as soon as practicable.

Practicable is not defined in the legislation and has its usual meaning which is, as soon as realistic, possible or feasible.

For these purposes the ATO accepts that payment of a death benefit lump sum or a new death benefit pension within 6 months of the member’s death is reasonable. However, if payment is not possible within that time, because there are issues delaying the payment of the benefit, then a longer period will be accepted if the trustees can show valid reasons why payment has been delayed.

Q: How to practically pay out SDB (superannuation death benefit) when SMSF investments include many unlisted investments, If an SDB is paid outside the 6 months mainly due to awaiting tax statements we won’t be claiming ECPI subsequent to the DOD FY. any issues?

A: The ATO accepts as a general rule that death benefits should be paid within 6 months of the member’s death. However, where it is expected that the transfer or realisation of the fund’s investments may take longer than that it is up to the trustee to provide reasons for the delay in payment of the death benefit.

As a general rule waiting for tax statements relating to the investment would fall into this category.

TPD payout from super fund

Total and permanent disability benefits can be paid from the fund as pensions or lump sums depending on the rules of the fund and the member’s choice of the payment.

Pensions

Where a member is under age 60 the taxable component of a TPD pension is taxed at ordinary personal rates but receives a 15% tax offset. From age 60 the pension is tax free. (s 301–40, ITAA97)

Lump sums

Lump sums paid on the total and permanent disability of a member receive concessional tax treatment as the tax-free component is increased by the amount of the benefit that would have been received had the person not become disabled (s 307–145, ITAA97). The increased amount is calculated by using a formula which is based on the total benefit apportioned over the member’s service period and days to retirement from the time they were disabled.

The formula is:

Where: days to retirement is the number of days from when the person stopped being capable of being gainfully employed to his/her last retirement day.

Q: What scope for rectification exists when TRIS max has been exceeded? (Payment made direct to 3rd party for personal expense)?

As a general rule once the TRIS max has been exceeded then it fails to meet the pension standards. The TRIS is considered to have ceased from the commencement of the financial year in which the overpayment occurred. It is not possible for the ATO’s 1/12 th rule to apply to overpayments, that rule only applies only applies on a once only basis to underpayments.

To work out whether a rectification is possible you would need to consider the circumstances which led to the excess being paid. If the payment was made direct to the 3 rd party for a personal expense, and it has been outstanding for a short period then maybe the payment was made in error and the fund could be reimbursed. If the member has any unrestricted non-preserved benefits, then it could be claimed that the amount paid to the third party was really paid from those benefits and the accounting to withdraw the amount from the pension account was made in error and was really the payment of a lump sum from the unpreserved benefits.

Investments

Q: If an investment is in liquidation, can the trustee reduce the value to $1, so as to avoid a qualification?

This is a good question as many accountants have a tendency to place a nominal value on the value of the investment as in their opinion the likelihood of recovery due to liquidation is slim. If the value of $1 placed on the share represents its market value, then it may be accepted for SIS purposes.

However, the ATO says that for CGT purposes the value of the shares is based on the following where:

a shareholder, and a liquidator or an administrator of a company declares in writing that they have reasonable grounds to believe there is no likelihood that shareholders will receive any further distribution for their shares, or an investor who holds a financial instrument in a company, and the liquidator or administrator of the company makes a declaration in writing that the financial instrument has no value or negligible value.

Q: How often should Trustees undertake a comprehensive commercial property valuation once unrealised gains are to be taxed?

The provisions of regulation 8.02B of the SIS Regulations require that the assets of a superannuation fund are valued at their market value from year to year. This value is to be in accordance with the ATO’s valuation requirements that the valuation is based on objective and supportable data. The valuation of a member’s total superannuation balance for purposes of Division 296 tax uses the market value of the investments which takes into account the increase in the value of the fund’s assets including unrealised capital gains.

Please note that it is unlikely Division 296 tax will become law in the current sittings of the Parliament and its reintroduction into the Parliament may depend on the outcome of the Federal government election to be held in 2025.

Q: How to best gain sufficient appropriate evidence for SMSF investments in unlisted companies and trusts?

The main issue when obtaining appropriate evidence to determine the value of the fund’s investments in unlisted companies or trusts is that accounts may be maintained at cost. Accounts which value the assets of the unlisted company or trust at market value can be difficult, if not impossible, to obtain. Where the value of the fund’s assets cannot be obtained it may be necessary for the auditor to qualify the fund accounts.

It is up to the fund’s trustee to verify that the appropriate valuation of the shares, units or other investments in the unlisted company or trust are at their market value.

Q: Valuation requirements and process for members to purchase a fund asset (property)?

The valuation requirements and process for members to purchase an asset from the fund should be in line with the ATO’s valuation guidelines and the provisions of the SIS Act. For example, if a collectable or personal use asset is being acquired from the fund by a related party then it is necessary under reg 13.18AA(7) of the SIS Regulations to obtain a valuation from an appropriately qualified independent valuer.

Other questions

Q: Does the payment of a fund expense personally by the trustee which is processed as a contribution create a NALE event?

The answer to this question depends on the circumstances. However, in isolation, if the trustee paid the expense and the amount paid was considered to be on an arm’s length basis then it is unlikely a NALE event would have occurred.

Probably the best strategy in these cases is for the fund to reimburse the trustee for the fund expense and a cash contribution made by the contributor to avoid any likelihood of the transaction being treated as a NALE event.

Q: What can be done when individual trustees(ex's) where ex-wife is not cooperating and taking illegal withdrawals?

This is a matter that needs to be sorted out with the particular financial institution to see whether they are prepared to freeze the accounts or investments. What should have been done as part of any family law settlement is that the authority on the fund’s bank accounts and investments require both parties to consent to the payments from the fund or the sale or transfer of assets. Another option could be to have account transactions and investments frozen so that no withdrawals can be made from the accounts. The ATO as regulator of SMSFs can exercise its powers to freeze the fund accounts and investments but this may take longer than is reasonable.

Q: Life Time Complying Pensions – when is it best to move on from this product and is it only the choice to move to a market linked?

A: The answer to this question depends entirely on the circumstances of the particular client and the reasons they wish to move from the life time complying pension to a market linked pension.

Currently, Treasury has published draft regulations [Treasury Laws Amendment (Self- managed superannuation funds—legacy retirement product conversions and reserves) Regulations 2024 (draft regulations)] which, if it becomes law, will allow a member to commute the pension and transfer the commuted amount to the member’s accumulation phase. This is required to take place within 5 years of the legislation becoming law. The commencement date will not be known until the legislation is lodged in the Parliament. In view of the tax concessions available in this draft legislation is may be worthwhile to wait until we see the final legislation.

Q: If a fund invests via a wrap account is it sufficient to rely on their reports if we have an audit report from the wrap provider outlining internal controls? Or should we just utomatically qualify our audit report, I cannot see many trustees keeping their own records to substantiate the transactions in the wrap account, that is the whole point of investing in a wrap account so the trustees do not need to do this.

A: In the case of Investor Directed Portfolio Services (IDPS) (WRAP accounts), it’s necessary for the trustee to obtain an auditor’s report issued in accordance with ASAE 3402. Where data has been transmitted via the use of data feeds, then an ASAE 3402 type 2 Assurance report that relates to the operating effectiveness of the processes and controls is required.

In the absence of the required document, the auditor is restricted in providing an opinion on the accuracy of the reports provided by the IDPS. Because the report in accordance with ASAE 3402 has not been provided to the fund auditor then they would qualify the audit report and lodge an Audit Contravention Report with the ATO. It is up to the trustees to ensure adequate documentation is obtained which support the market value of investments. As the question indicates it may result in many trustees keeping their own records in relation to the wrap account which negates the point of its use.

Q: Any idea if the $1.6M disregarded small fund assets will be indexed to 1.9M to align with transfer balance cap?

A: The Explanatory Memorandum to the Treasury Laws Amendment (Fair and Sustainable Superannuation) Bill 2016 clearly states that an individual’s transfer balance cap will be indexed in line with changes to the Consumer Price Index. However, the $1.6 million amount used for disregarded small fund assets will not be indexed.

Here is an extract from the relevant part of the Explanatory Memorandum: 3.17 An individual's transfer balance cap is $1.6 million for the 2017-18 financial year and is subject to proportional indexation on an annual basis in $100,000 increments in line with the Consumer Price Index (CPI).

10.53 It will not be necessary for a person with an interest in the small fund to be receiving an income stream from that fund. A small fund will be excluded from using the segregated assets method where a member of the fund, with a total superannuation balance that exceeds $1.6 million, is a retirement phase recipient

of an income stream from another superannuation income stream provider.

Q: You only have 2 goes at paying the benefit….is there flexibility there?? (think this relates to death benefit)

A: The provisions of regulation 6.21 of the SIS Regulations is a compulsory cashing requirement that applies only where a death benefit is payable. The regulation says that ‘a member's benefits in a regulated superannuation fund must be cashed as soon as practicable after the member dies’ for each person to whom benefits are paid as:

• a single lump sum, or

• an interim lump sum and a final lump sum.

Where benefits are paid in other circumstances the legislation does not place restrictions on the number of lump sums that may be paid.

There are a number of situations on the death of a member, where it may be impossible to comply with this requirement. An example would be when a death benefit is paid by the transfer of shares. It is understood that each parcel of shares constitutes a lump sum and may not meet the compulsory lump sum payment requirements of regulation 6.21.

Q: In a scenario where the sole member of a SMSF (Corporate Trustee structure with deceased member and non-dependent adult child as directors) passes away and the death benefits re to be paid out to the deceased's non-dependent adult child (age 60+), I assume we are meant to calculate the PAYG Withholding first before arranging for the death enefits to be paid out i.e. Gross Payment (Deceased member's balance in SMSF) LESS PAYG Withholding = Net Amount to be paid out. However, how would the PAYG Withholding spect of this scenario work if the beneficiary is opting to receive a portion of the death benefits as an in-specie transfer of listed shares ($100k market value) into their personal name?

A: In circumstances where tax is payable to a non-dependant child as a lump sum, PAYG is required to be deducted from the lump sum payable. The amount of tax payable is calculated on the taxable component of the death benefit lump sum.

If the death benefit is made as an in specie transfer of assets the value of the shares transferred in is included in the lump sum and subject to tax on the taxable component. The fund is required to pay PAYG based on the value of the assets transferred in specie and any cash included in the death benefit lump sum.

Q: Any examples of when the super fund holds a large value of cryptocurrency and they have lost the wallet access details upon death of a member? how long could this take?

A: In some cases, this issue may never be solved. However, as the benefit is required to be paid as soon as practicable, locating the wallet may take a long time. Providing the trustees are making reasonable attempts to locate the wallet then it may be regarded as falling within the ‘soon as practicable’ requirement.

Q: Single member fund with property – takes 2 years to sell down all the assets – still ECPI until benefits paid to the estate?

A: Whether the assets and relevant income would come within the fund’s ECPI, depends on the circumstances of the case. There are a number of situations where it could occur, for example:

• where a reversionary pension is paid to a death benefits dependant,

• if a non-reversionary pension was paid to the deceased.

The residual amount of the non-reversionary pension will remain in the fund’s exempt pension assets until the beneficiary makes a decision whether they should receive a death benefit such as a lump sum or death benefit pension. If the death benefit pension has been selected then the assets supporting the death benefit pension will remain as part of the fund’s exempt current pension income.

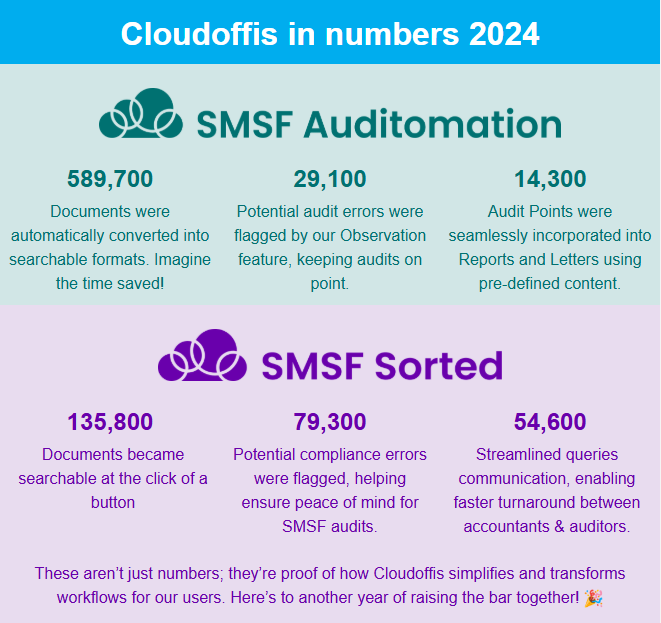

Information from Graeme Colley and Cloudoffis is general in nature. It does not take into account your objectives, financial situation or needs. Before acting on any information, you should consider the appropriateness of the information provided.

Disclaimer

The information provided here is intended to be general in nature and is not personal financial (or financial product) advice. It does not take into account the objectives, financial situation or needs of you or your client.

Before acting on any information, you should consider the appropriateness of the information provided having regard to the objectives, financial situation and needs of you or your client. In particular, you should seek independent professional advice prior to making any decision based on the information provided in the video or text.

You should consider the appropriateness of this information having regard to the individual situation and seek taxation advice from a registered tax agent before making any decision based on the content of this presentation.

Any examples and calculations within this presentation are provided for illustrative purposes only. They should not be relied on.

Viewing the content provided, is considered as acknowledgement, acceptance and agreement to this Disclaimer and the contents contained within.