It’s an exceptionally busy time for the SMSF industry, especially our Auditors who have been working overtime to hit deadlines. We’d like to share our gratitude to all the SMSF Auditors out there that are working tirelessly to keep our industry, SMSF Accountants and Trustees, safe and compliant.

This month, we’re proud to feature a new tip sheet to help you rethink your practice management as you head into the new financial year. The feedback from across our network has demonstrated that there is a strong need for improved operational excellence to help with growth and compliance. Based on these conversations, we’ve compiled three proven trategies to help you enhance your practice management in 2024. Take a read below.

We’re also sharing some short videos that our team has been working, providing you with a new way to consume the Cloudoffis product updates for Auditors and Accountants alike. Grab a coffee and jump on in

Industry trends

Rethink your Practice Management: 3 proven strategies

Are you an auditor looking for ways you can rethink your practice management to help you stand out from the competition without resorting to price reductions?

The answer lies in delivering exceptional customer service as your point of difference, ensuring customer satisfaction and generating referrals from their network.

Maintain your brand integrity with secure data sharing and storage

If safeguarding your brand reputation and securing your clients’ data is a top priority, we invite you to review our updated Data Security Policy.

Our platform not only ensures secure data storage but also features robust access controls to protect you, your staff, and your clients. With administrator-defined access levels in Cloudoffis, your team members can only access the information necessary for their roles, ensuring maximum security and efficiency.

Product update

Say yes to manual files and start auditing straight away

In an industry first for our Auditing community, Cloudoffis has delivered an easy way for you to receive manual files such as PDF, excel or CSV from your clients.

With our manual uploads feature, we turn your manual files into structured data that’s ready to audit immediately, so you can say goodbye to intricate, error-prone ways of working and hello to new revenue and happy clients.

Watch this 2 minute video to learn more about this much loved feature that can help you increase your revenue.

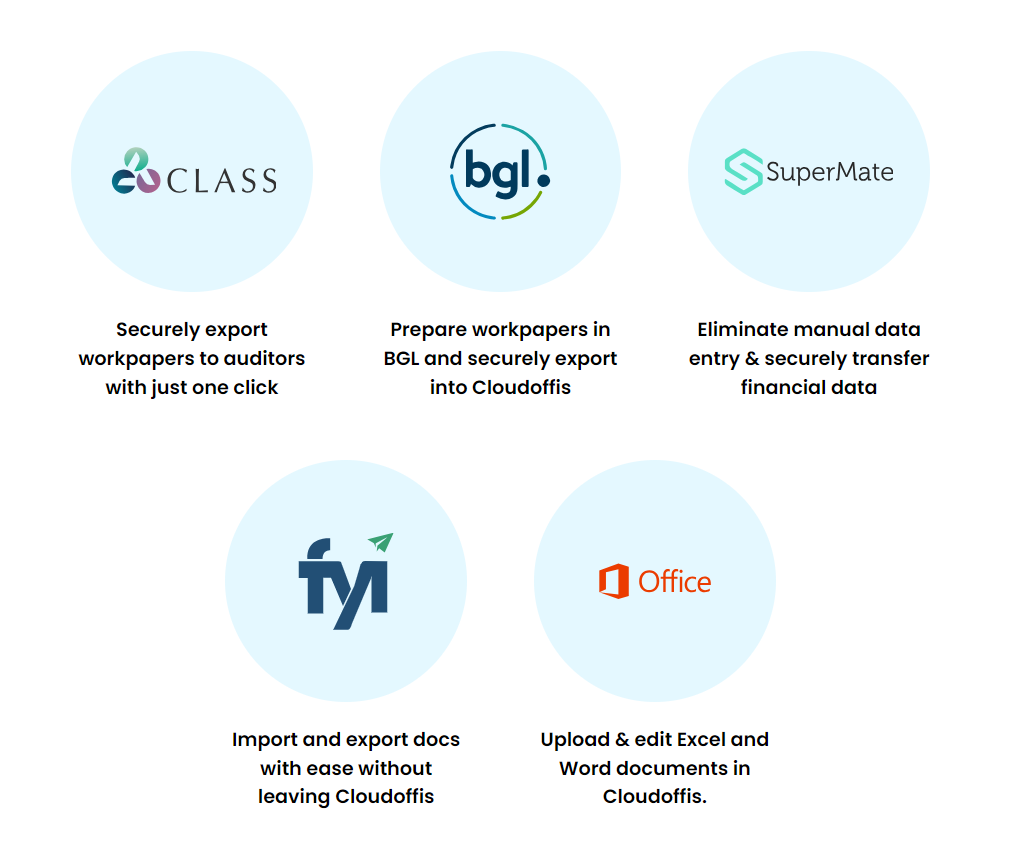

Import and export documents securely between SMSF Sorted and FYI

Document management is a time-consuming, yet important task to get right, which is why we are thrilled to introduce our integration between SMSF Sorted and FYI.

With just the click of a button, you can access and import all your documents stored in FYI from your SMSF Sorted account and once your workpapers are generated, you can effortlessly save them back into your preferred cabinet in FYI, all without leaving SMSF Sorted.

If you’re an accountant looking to boost productivity, watch this 1 minute video to see how you can securely transfer documents between Cloudoffis and FYI Docs so you never have to go searching for paperwork again.

Automate, submit and track your audit jobs with ease

Keen to see how the new and improved Class x Sorted Lite integration works? Watch this short video to see how you can automate your workpapers, submit workpapers in just one click and track your audit jobs.

Experience more of the new Cloudoffis

More than 55,000 funds have been processed on Cloudoffis in FY23. If you think there’s room for you to optimise your practice, enhance operational efficiency, or elevate customer experiences this year, now may be an opportune time for us to connect.