Is the average of SMSF members/trustees increasing?

Based on the information compiled by the ATO from SMSF Annual Returns, there is a slight variation in the age of members/trustees at the time the SMSF is established. The latest statistics compiled from the 2019-20 to 2023-24 SMSF Annual Returns show that the median and average member age in the year an SMSF is established is between ages 46 and 47. However, the average and median age of all members is around age 62.

There appears to be a decrease in the proportion of individuals establishing SMSFs who are aged under 35 and between 55 and 59. There is an increase in the proportion of individuals establishing funds who are aged between 35 and 54.

Age ranges of SMSF members as at 30 June 2025

The following table, published by the ATO and based on data compiled by the

Australian Business Register, shows:

- The approximate age distribution of SMSF members at 30 June 2025

- The age distribution of members of SMSFs established in each income year from 2019-20 to 2023-24

The main points of the data are:

- As at 30 June 2024, both the average age and the median age for all SMSF members were 62 years

- The median age of SMSF members of newly established funds in 2023-24 was 46 years

Age distribution of all SMSF members at June 2024, and members by the establishment year of the SMSF

Age Distribution of All SMSF Members at June 2024, and Members by Establishment Year of the SMSF

| Age Range | All Members 2024-25 | 2023-24 | 2022-23 | 2021-22 | 2020-21 | 2019-20 |

|---|---|---|---|---|---|---|

| < 25 | 0.6% | 1.2% | 1.4% | 1.4% | 1.4% | 1.7% |

| 25 – 34 | 2.7% | 8.5% | 8.2% | 9.9% | 9.9% | 12.2% |

| 35 – 44 | 12.2% | 35.6% | 33.4% | 35.0% | 34.1% | 32.8% |

| 45 – 49 | 9.5% | 18.1% | 17.6% | 17.7% | 18.5% | 17.7% |

| 50 – 54 | 11.9% | 15.9% | 16.6% | 15.6% | 15.6% | 14.8% |

| 55 – 59 | 12.3% | 10.8% | 11.8% | 10.8% | 11.2% | 11.1% |

| 60 – 64 | 12.6% | 6.0% | 6.5% | 5.8% | 5.8% | 5.8% |

| 65 – 69 | 11.5% | 2.6% | 2.9% | 2.5% | 2.3% | 2.5% |

| 70 – 74 | 10.0% | 1.0% | 1.2% | 0.9% | 0.8% | 1.0% |

| 75 – 84 | 13.7% | 0.4% | 0.5% | 0.4% | 0.3% | 0.4% |

| 85+ | 3.0% | <0.1% | <0.1% | <0.1% | <0.1% | <0.1% |

| Total | 100% | 100% | 100% | 100% | 100% | 100% |

| Average member age | 62.0 | 47.0 | 47.4 | 46.5 | 46.6 | 46.2 |

| Median member age | 62.4 | 46.2 | 47.0 | 46.0 | 46.2 | 46.0 |

Source: ATO SMSF Annual Overview 2023-24 Self Managed Superannuation Funds

Updated 17/12/2025

Members of SMSFs as at the end of June 2025

The following table contains the age distribution of individuals who were members of SMSFs as at the end of June 2025 and is based on Australian Business Register (ABR) data.

Table 6: Members, by Gender and Age Range

| Age ranges | Male | Female | Total |

|---|---|---|---|

| < 25 | 0.6% | 0.6% | 0.6% |

| 25–34 | 2.7% | 2.8% | 2.7% |

| 35–44 | 11.8% | 12.7% | 12.2% |

| 45–49 | 9.5% | 9.5% | 9.5% |

| 50–54 | 11.7% | 12.1% | 11.9% |

| 55–59 | 12.1% | 12.5% | 12.3% |

| 60–64 | 12.5% | 12.7% | 12.6% |

| 65–69 | 11.4% | 11.6% | 11.5% |

| 70–74 | 10.0% | 10.1% | 10.0% |

| 75–84 | 14.3% | 13.0% | 13.7% |

| 85+ | 3.5% | 2.4% | 3.0% |

| Total | 100% | 100% | 100% |

| All ages | 52.7% | 47.3% | 100% |

Source: ATO SMSF Quarterly Statistical Report – September 2025

Self Managed Superannuation Funds – Updated 17/12/2025

If the fund owns real estate, is the auditor required to obtain a title search each year indicating its ownership and whether it is encumbered. Is there an alternative?

Both the ATO and the Administrative Review Tribunal consider it is necessary that a title search be undertaken each year to satisfy the requirements of the Superannuation Industry Supervision Act (SIS Act). The search is required to establish that the trustees have met the requirements of section 65 of the SIS Act and regulations 4.09A and 13.14 of the SIS regulations.

The reason for requiring the title search each year are:

Section 65: loans or financial assistance to members

To check whether the fund has met the requirements of section 65, the auditor

must be satisfied that the fund has not lent money or provided financial

assistance to members and relatives. This requires the auditor to:

-

Examine bank statements and obtain explanations from trustees about any

unusual transactions, including transfers of money to members or relatives -

Check details of all loans by the fund, including the parties to the loan,

loan term, interest and repayments -

Check any transactions with related parties to determine whether members

or relatives have received financial assistance -

Review the ownership of fund assets to ensure the investment is owned by

the fund and that no charge or other form of security has been taken over

any of the SMSF’s assets to secure a member’s or relative’s personal borrowing

Whether the fund’s assets have been used to secure borrowing can only be

determined by a title search or other independent verification.

Regulation 4.09A: separation of assets

To determine whether the fund’s money and assets are held separately from money and assets held personally by the trustees or a standard employer-sponsor the auditor should:

- sight asset ownership documents, including bank statements, to verify SMSF assets are held in the name of trustees on behalf of the fund (for example, R & J Smith as trustees for the Smith SMSF or R Smith Pty Ltd as trustee for the Smith SMSF)

- scheck for alternative documentation that protects the fund’s assets (for example, a valid declaration of trust or title documents) where State law prevents ownership in the name of the SMSF

- sreview transactions on bank statements to ensure fund money is not mixed with money belonging to related parties of the SMSF.

Regulation 13.14: charges over assets

The auditor needs to check that the fund has complied with regulation 13.14 to confirm that the trustees have not given a charge over or in relation to a fund asset by obtaining:

- written representations from the trustees

- annual property title searches for real properties

- searches of the Personal Property Securities Register External Link for interests registered by other parties against SMSF assets.

Where there has been a change in trustees, the auditor should obtain evidence that the ownership of asset documents reflect the change.

An update on Court and Tribunal Decisions

Reviews by regulators and the courts in recent years show that proper documentation is essential. One case is the Administrative Review Tribunal decision in Murphy v ASIC [2025] ARTA 75 (6 February 2025).

In the case, the ATO reviewed the audit files of Mr Murphy which were referred to ASIC because of various auditing and independence breaches. One of the fund’s audited showed

● no evidence of the ownership of a property in Victoria as no title search was undertaken for for the relevant year(s),

● failed to determine whether a borrowing complied with s67 of the SIS Act – trustees were concerned about compliance, and

● deficiencies in the audit engagement letter issued by Mr Murphy for the audit which resulted in the trustees being concerned about compliance.

The Tribunal confirmed the ASIC decision to disqualify Mr Murphy’s registration as an SMSF auditor.

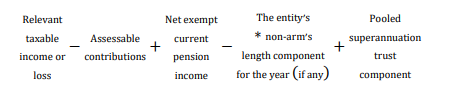

Given the rules surrounding non-arm’s length income (NALI) , if someone processes their own SMSF by using the firm’s software which is not material to the firm, what are the consequences?

The answer to this question can be found in the finalised version of Law Companion Ruling LCR 2021/2 which was published in September 2025. The ruling clarifies how the non-arm’s length provisions of the tax law work for non-arm’s length expenditure incurred by an SMSF.

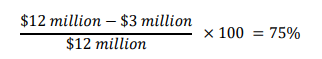

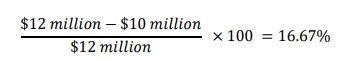

Example 2 at paragraphs 24 to 26 of the ruling is about Mikasa who is a trustee of her SMSF and a partner in an accounting firm. She engages her firm to provide accounting services for the SMSF which include administration services for the fund. The firm does not charge for the services it provides and as a result they are considered to be non-arm’s length dealings between the firm and the fund trustee. In view of this the ATO’s opinion is that a penalty applies to the non-arm’s length income for purposes of section 295-550 of the SIS Act. The penalty is equal to twice the difference between the amount of the expense that might have been incurred has the parties been dealing at arm’s length and the amount of the expense incurred by the fund.

There is an exception to this in Paragraph 51 of the ruling where a staff discount policy applies and the fund is entitled to a discount which is provided to all employees, partners, shareholders or office holders and it is consistent with normal commercial practices.

With an increase in the number of SMSF auditors being disqualified, what should I do? How can technology help me?

This question is not easy to answer as we do not know about your situation. However, provided you are meeting the ATO’s compliance audit requirements and the professional audit standards then you should not have any issues to be concerned with. You may like to contact your professional association to see whether they have a review service which can let you know whether you meet the relevant audit requirements.

It’s important to look at your overall audit process and where you can create more efficiencies and avoid any compliance issues. There are many platforms that allow you to streamline this process. SMSF Auditomation, by Cloudoffis allows you to streamline your process and ensure you are audit ready.

If you’d like to speak to one of the Cloudoffis experts, you can reach out here.